STORY HIGHLIGHTS

- Fraud is rampant in California's drug rehabilitation program for the poor, with clinics cheating taxpayers by billing for counseling that never happened

- Clinic operators are accused of pressuring staff to forge and falsify paperwork to pad bills

- California's Medicaid system, the biggest in the nation, paid $94 million in the past two fiscal years -- half of public rehab funding -- to clinics that have shown signs of fraud or deceptive billing

Editor's note: To uncover this story on widespread fraud linked to California's drug rehab program, CNN's Special Investigations Unit has teamed up with the independent, nonprofit Center for Investigative Reporting. Join CNN's Anderson Cooper on AC360 for more on this yearlong investigation Tuesday and Wednesday at 8 and 10 p.m. ET on CNN.

(CNN) -- Victoria Byers did not drink alcohol. She did not abuse drugs. But when she was a teenager in foster care, several times a month, she would board a van at her group home and go to rehab.

Byers couldn't figure out why she had to take drug tests and sit in group therapy sessions on addiction at So Cal Health Services, a clinic tucked in an office park in Riverside, California.

"And I told them, you know, 'Why should I be here? I have no drug issue,' " said Byers, now a slow-to-smile 22-year-old.

The director of Byers' group home confirmed Byers was clean but said she sent all six girls under her care to the clinic because she didn't have enough staff to separate those with substance abuse problems.

Troubled drug rehab clinics

Troubled drug rehab clinics

Troubled drug rehab clinics

Troubled drug rehab clinics

Troubled drug rehab clinics

Troubled drug rehab clinics

HIDE CAPTION

The arrangement was strange. It was also a scam.

So Cal Health Services was ripping off taxpayers, part of a pattern of fraud by rehabilitation clinics that collect government funding to help the poor and addicted, a yearlong investigation by The Center for Investigative Reporting and CNN has found. The investigation, which included undercover surveillance and stakeouts, uncovered a rehab racket that continues to this day.

Thousands of pages of government records and dozens of interviews with counselors, patients and regulators reveal a widespread scheme to bilk the state's Medicaid system, the nation's largest. Witnesses to the fraud laid out its inner workings in minute detail, some speaking of it publicly for the first time.

In the underbelly of the Drug Medi-Cal program, clinics pad client rolls by diagnosing people like Byers with addictions they don't have. They round up mentally ill residents from board-and-care homes to sit in therapy sessions they can't follow. They lure patients in from the street by handing out cash, cigarettes and snacks. They have patients sign in for days they aren't there.

One Inglewood clinic fabricated notes and billed for "ghost clients" who never came in. They couldn't show up, a counselor discovered: Some were behind bars; one was dead.

Even caught red-handed, operators have polished techniques to ward off official scrutiny and keep the money flowing. One Los Angeles County clinic director lodged a complaint against a government auditor, and another called on a local lawmaker for help. In both cases, it worked.

The populous Los Angeles region is one of the nation's top hot spots for health care fraud, and former state officials agree it is also ground zero for the rehab racket.

Drug Medi-Cal paid out $94 million in the past two fiscal years to 56 clinics in Southern California that have shown signs of deception or questionable billing practices, representing half of all public funding to the program, CIR and CNN found. Over the past six years, more than half a billion dollars have poured into the program statewide.

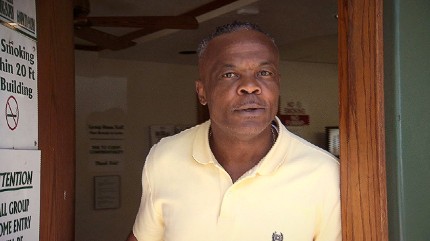

Victoria Byers said that as a teenager, her group home took her to So Cal Health Services in Riverside, California, for rehab even though she didn't drink or do drugs. (Photo: CNN)

Following a year of public records requests and questions from CIR and CNN, state regulators announced a crackdown in mid-July. The action came two and a half weeks after reporters submitted a final list of their findings.

The state Department of Health Care Services temporarily suspended 16 clinics suspected of flouting the law and pledged to tighten oversight and on Tuesday announced it had suspended 13 more. Officials would not identify the targeted clinics, saying the information would compromise the investigation.

But veteran operators have become adept at sidestepping trouble.

Among them was Tim Ejindu, who ran the clinic where Byers was sent.

Nearly one-third of the foster children who showed up at Ejindu's clinics in Riverside and Pomona had no drug or alcohol problem, estimated TaMara Shearer, a former addict who worked as a supervisor.

"Any loopholes, he knows how to find them. I've watched him do it," Shearer said. "He thinks Americans are dumb."

Under pressure to diagnose teenagers with fake addictions, counselors at the clinics reverted to racial stereotypes, according to Shearer. They labeled white teens as alcohol drinkers and black or Latino teens as marijuana smokers, she said.

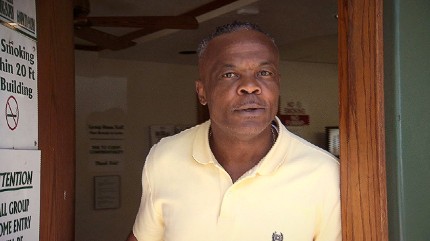

TaMara Shearer, who worked at So Cal Health Services and the Pomona Alcohol and Drug Recovery Center, says the clinics billed for services that didn't happen and diagnosed teenagers with fake addictions. (Photo: CNN)

Ejindu did not respond to an interview request or a letter outlining allegations against him. When contacted by reporters at his clinic, he declined to answer questions, closing the clinic door and refusing to reopen it.

Joy Jarfors, a manager with the state Department of Alcohol and Drug Programs until she retired in 2010, said "fraud and abuse (are) rampant" in the system.

"I'm not the employee anymore that has to look at this every day, but I'm a taxpayer that knows that this is going on," Jarfors said. "It angers me. And there's story after story after story about Medicaid dollars being cut from people who need the services."

The cost of failing to treat addicts is high. Drug overdose and excessive alcohol consumption are among the top causes of premature death in Los Angeles County, killing two people nearly every day. Statewide, the Legislative Analyst's Office has found taxpayers spend more than $1 billion a year on hospital stays related to substance abuse for those on Medi-Cal.

"Everyone talked the talk, everyone was zero tolerance for fraud and abuse, but nobody would do anything about it," said Joy Jarfors, a manager with the California Department of Alcohol and Drug Programs until 2010. (Photo: CNN)

The rehab centers promise a chance to start over in their very names, which include phrases like "new hope," "new beginning," "renew" and "U-turn." But they don't always deliver.

Vredette Hawkins was one woman who could have used some help. The South Los Angeles mother of four smoked marijuana and was under scrutiny from child welfare officials, she said, after someone accused her of using methamphetamine.

She went to a nearby Drug Medi-Cal clinic a year ago to get counseling for depression. She encountered a chaotic free-for-all, a clinic filled with people who came only because they wanted money.

At Basen Inc., clients received $5 each time they showed up, she said. Hawkins said counselors often abandoned group therapy sessions after 15 minutes, leaving clients to chat about sexual exploits and getting high. Two former Basen employees also told CIR that the clinic paid clients, although one said that the practice stopped amid worries about getting caught.

A county investigation last year found "extremely serious violations," such as falsified paperwork, but couldn't substantiate allegations that Basen was paying clients.

"The only one that's basically benefiting from all this," Hawkins said, "is ... the person that's running the program."

Bassey Enun-Abara, the counseling center's executive director, said he does not pay clients and disputed Hawkins' description of the clinic. "I can't believe a client would tell you that," he said.

As director of the state Department of Health Care Services, Toby Douglas has primary responsibility for Medi-Cal, including the rehab system. Douglas, appointed by Gov. Jerry Brown in 2011, declined repeated interview requests.

Douglas' boss, Secretary Diana Dooley of California's Health and Human Services Agency, also declined interview requests. Approached by CNN in June outside a public meeting in Sacramento, Dooley headed for a restroom, which was locked.

She then said: "The state of California takes fraud very seriously, and there are many investigations that are underway. The allegations -- all allegations are given full and fair consideration."

Dooley added that her agency's fraud and investigation unit is "one of the best in the country." She ended the brief conversation with, "That's all I have to say."

Asked again whether Douglas would sit down for an interview, as she stepped into an elevator, Dooley put her hand over CNN's camera and called for security. Later, her spokesman offered a sit-down interview with Douglas if CNN discarded the footage of Dooley. CNN and CIR would not agree to that condition.

A month later, Douglas announced his crackdown.

The agency's chief deputy director, Karen Johnson, declined to discuss accusations about specific clinics and acknowledged that the state does not yet "know the expanse of the problem."

Related: Rehab racket includes frauds, felons and fakes

Unreachable clients

Addiction counselor Tamara Askew discovered something wrong soon after she started working at Pride Health Services in Inglewood, southwest of downtown L.A., in 2009.

Askew grabbed a stack of files and began contacting patients to introduce herself. That was harder than she had figured.

Some were in jail, Askew said. Several never showed up. One man she reached out to was dead.

"After that, it was like, 'Are you kidding me?' " Askew said in an interview. "God rest his soul but, I'm like, 'How are you billing (for him)?' "

When it came time to bill Drug Medi-Cal for services rendered, Askew said her boss, Godfrey Nwogene, wanted her to submit paperwork showing that all of those clients, living and dead, had been attending counseling sessions.

The more clients Pride Health Services reported treating, the more money it could charge the government.

"He basically said, 'How do you think you're going to get paid?' " Askew said.

When Askew would not sign off on billing for clients she hadn't seen, her boss unplugged her computer, she said, and told her to leave.

Askew sued Pride, claiming she was fired for refusing to falsify records. Pride Health Services contended in court filings that Askew was laid off because there wasn't enough work. Askew and Pride eventually settled, and a judge ordered the clinic to pay her $15,500.

The clinic kept reaping more than $800,000 annually in government funding, despite persistent allegations of fraud and serious violations documented by auditors.

This year, a whistle-blower told Los Angeles County officials that Nwogene still was billing for "ghost clients." When confronted by county regulators, Nwogene and his staff denied wrongdoing.

Without hard evidence, auditors couldn't substantiate the allegations. They might have had more luck if they had visited Pride on a Wednesday.

Inside Pride's Inglewood clinic, between a dairy mart and a gas station on busy Crenshaw Boulevard, a small lobby was empty April 3, save for artificial plants and a 1990s-era anti-alcohol poster.

A receptionist told reporters there were no counseling sessions that day.

The office offered no group therapy on Wednesdays, she specified, in an exchange caught on a video camera hidden in a watch.

Yet billing records obtained by CIR and CNN show that Pride Health Services charged taxpayers for counseling 60 people at the clinic that day, at a cost of about $1,600. The clinic was reimbursed for 62 patients the following Wednesday as well.

Nwogene, whose salary has reached as high as $120,000 a year, did not respond to requests for an interview or to a letter seeking responses to specific allegations. When reporters asked for him at Pride's Inglewood clinic, a staffer denied wrongdoing. Workers then called police and closed the office mid-day.

Fake diagnoses among foster children

In California's public drug rehab program, clients equal cash. State and federal taxpayer money flows to the local privately run clinics based on the number of people they serve. The counseling is free to those on Medi-Cal.

California spent nearly $186 million on the program in the past two fiscal years, according to figures from the Department of Health Care Services. That doesn't include methadone clinics for heroin addicts, a separate wing of Drug Medi-Cal.

The state has the nation's largest population of people who qualify for the benefit, a pool poised to grow sharply under the Affordable Care Act. But recent history suggests that expansion might shovel more funding to clinics that game the system.

A specialty of So Cal Health Services, the Riverside clinic to which Victoria Byers was sent, was diagnosing foster children with fabricated drug and alcohol problems and billing taxpayers for the unneeded services, according to former employees and whistle-blower complaints.

The clinic billed Riverside County between $31 and $75 for each counseling session a child attended, documents show.

"You'd have to make up a summary of them trying this drug and make up scenarios of how they tried it, how they got it," said Nadine Cornelius, a former counselor. "It was all lies."

Cornelius tried making her group therapy sessions educational, she said during an interview at a diner near her San Bernardino County home. But eventually, she gave up. Instead, she said she let the teenagers play bingo and watch movies.

An anonymous whistle-blower told county officials that So Cal was paying group homes for "access" to the foster children. Byers' group home director, Angelina Farmer, told CIR that wasn't the case.

Riverside County cut So Cal Health Services' contract in 2010 because so many of its clients had dropped out. That failure was easier to prove than the fake diagnoses of teenagers, according to Karen Kane, the county's substance abuse program administrator.

Kane said her agency was especially concerned that a false addiction diagnosis could negatively affect the foster children later in life.

"Our goal was to stop them from harming people and get them out of the business -- and that's what we did," Kane said.

By then, the county already had paid So Cal $1 million, dating back to mid-2007.

After the closure, clinic director Tim Ejindu moved some staff members from Riverside to his other clinic in eastern Los Angeles County. There, under the red-tiled roof of the Pomona Alcohol and Drug Recovery Center, problems persisted.

Shearer, the Pomona center's assistant program manager before she left last year, said the overriding goal of the operation was to "get money." Staff billed for therapy that didn't happen, she said. They billed for clients who didn't show up. They billed for pizza parties and basketball games as if they were counseling sessions.

Ejindu was authoritarian and intimidating, said Shearer, who worked for him for six years. Inexperienced counselors making $9 an hour were under constant stress, she said, caught between doing something unethical and losing their jobs if they refused.

"And he made it very clear that your job depended on what you do and what you don't do," Shearer said.

When a government auditor showed up for an annual review, she said Ejindu would have his staff sneak files into his office so he could examine them. Then, Shearer said, he would send the files back to the counselor to change before the auditor saw them.

"Mind you, there's no way to ... go back and correct," she said. "There's only forgery."

Ejindu, who tax records show makes $150,000 a year running the clinic, branched out last year to provide addiction counseling at seven middle and high schools in the Pomona Unified School District.

Tim Ejindu, who runs the Pomona Alcohol and Drug Recovery Center, called his clinic a "pillar in our community." (Photo: CNN)

A school district spokesman, Ryan Hightower, said there have been complaints about the program but would not elaborate except to say, "Whenever something is brought up, we deal with it."

Fighting audits

As business boomed at the Pomona clinic, Mary Brantley couldn't keep up.

Brantley started as a counselor at Ejindu's Riverside clinic. After it closed, she moved on to the Pomona clinic. She said under Ejindu's watch, she was expected to produce paperwork and signatures for rehab counseling that never took place.

"When he had the schools in on it, I left because I couldn't do that much forging," Brantley said.

Ejindu's strategies for handling regulators became clear after Shearer took her story to county authorities in September.

As an auditor investigated Shearer's accusations of fraud, Ejindu offered the investigator a job, according to a county email. The auditor turned him down.

The 2012 investigation determined that the Pomona clinic had billed for 230 counseling sessions at times when the counselors were off work or at lunch. The inspector discovered that Ejindu himself had filled out, signed and dated patient records for a future date.

Six treatment plans and medical waivers lacked the required doctor's signature when the auditor first examined them. Weeks later, physician signatures appeared on the same documents, along with dates indicating they had been signed before the audit, according to the investigation report.

The tricks used to fudge paperwork had become so prevalent in the Drug Medi-Cal program that John Viernes Jr., Los Angeles County's Substance Abuse Prevention and Control director, warned all rehab providers in a 2010 memo that the practices were fraudulent and "will result in immediate contract termination." Viernes also warned that any offer of a bribe to a county staffer would be grounds for termination.

Over and over again, however, that threat fizzled.

Ejindu fought back. He filed a complaint against the county auditor, citing "illegal pilfering of documents." The allegations against his clinic, Ejindu wrote, came from disgruntled ex-employees who had been fired for not meeting standards.

"This agency has been around for 15 years for a very good reason," he wrote. "We are a pillar in our community and well respected."

Ejindu met with Viernes, who asked another county division to investigate the complaint of auditor misconduct. The inquiry determined that the auditor didn't have permission to take papers off the desks of clinic staff, Viernes said. As a result, he said, the findings of serious violations were "set aside."

Meanwhile, the Pomona clinic continued to rake in cash as part of its $800,000 annual contract. Vans still dropped off teenagers for rehab, and Shearer has grown cynical about the value of blowing the whistle.

"The funny thing is that it has been reported, many times, and nothing has ever been done," she said. "He's always found a way to circumvent that."

Looking back, Victoria Byers is upset, too. It bothers her that somewhere in official patient records, someone labeled her with an addiction she didn't have.

"Maybe if I wanted to get a job and that comes up, maybe I can't get that job because of drugs," she said. "I didn't do drugs, and that's kind of messed up."

'Ghost clients'

At Pride Health Services, addictions weren't the only things that Stephanie Jackson Parnell made up.

The former employee said the clinic operator, Godfrey Nwogene, would ask her to bill Drug Medi-Cal for clients she'd never seen.

"I just had to come up with stories," she said. "Using your imagination. Like as if it's someone standing right there."

Pride staffers would go through files of old clients to check whether their Medi-Cal numbers remained active, Parnell said. Each active number would become a Pride client again.

Parnell, who left and filed a whistle-blower complaint with the state in 2009, said she invented life stories for her fake clients. She still can rattle off vignettes of rehab fiction: "Client stated that she went to a party and relapsed. ... Client is saying she doesn't want to go out with those same friends."

Or sometimes, Parnell just copied and pasted notes from one file to another.

"It got so raggedy ... I would put one floppy disk in there and do 15 charts with everybody saying the same thing," she recalled.

When people did come in, Parnell would take down their information, and Pride would bill for them even if they never came back, she said. When the fake clients were due to complete their rehab program, Pride employees created diplomas to put in their files, she said.

"I was getting freaked out about it, but the money was good," said Parnell, who made $13 an hour.

Whistle-blower emails sent to a Los Angeles County auditor in 2011 accuse Nwogene of leaning hard on his workers to carry out the scheme.

"I refuse to do any ghost writing because that is illegal," one of the emails said. "The owner of Pride Health (Godfrey) had an emergency meeting last week and stated that if we didn't want to do the paper work the Pride Health way, then we should resign."

Nwogene seemed unstoppable. A Pride employee wrote in another email to an investigator, "One thing im (sic) kinda scared of is that he has told us that no one has been able and will never be able to take him down."

Nwogene's skill at avoiding a crackdown played out in full force in 2011, as he faced heat from both state and county authorities.

An auditor sat in on a group therapy session -- but no one showed up. The auditor reported that Pride "appear(s) to have developed fraudulent documentation to support their billing claims," according to a county memo.

"A serious problem has come up with this agency," one county regulator wrote in an email obtained under the California Public Records Act. "ALL ROSTERS SIGNED IN THE SAME HANDWRITING by, it appears ... the same person and all billing for this program will be disallowed."

The county froze funding and conducted a follow-up investigation that found "extremely grave violations" and "deficiencies that warrant the termination" of Pride's contract. Los Angeles County drafted letters notifying state officials and Nwogene that it was cutting off funding.

The state Department of Alcohol and Drug Programs drafted a letter to temporarily suspend Pride from the Drug Medi-Cal program because of "severe deficiencies" from 2005 to 2011.

Neither of the letters, according to county and state representatives, ever was sent.

Political intervention

Nwogene had been asking for help from the office of Mark Ridley-Thomas, one of five county supervisors. Now chairman of the county board, the former state senator represents the district where Pride operates.

The politician's aide, Salya Mohamedy, inquired, and Viernes, the county substance abuse prevention director, detailed the clinic's violations and allegations of fraud. Still, Mohamedy asked Viernes to set up a meeting "so that we can resolve this matter once and for all."

Internal emails show that this was not an unusual request: During the second half of 2011, Ridley-Thomas' aide contacted Viernes on behalf of half a dozen other rehab providers facing problems with regulators.

Nwogene met with Viernes on August 10, 2011. In a thank-you letter to Ridley-Thomas' aide, Nwogene called the meeting successful.

"Your intervention opened the door to dialogue," Nwogene wrote. "That dialogue led to a resolution."

While Pride may have had flaws, Nwogene wrote, "reckless and mean spirited" county staff treated the organization unfairly.

In the end, Pride Health Services' contract wouldn't be terminated. The funding spigot was on again.

In an interview, Viernes expressed frustration that supervisors urged him to meet with clinic owners even when they knew about the serious problems found by auditors.

"I get emails from the supervisors, (saying), 'When are these people gonna get paid!'" Viernes said.

Ridley-Thomas' top health deputy, Yolanda Vera, denied pressuring Viernes. The lawmaker's office got involved, she said, to "make sure that these agencies at least are getting some access and having their concerns addressed."

Asked about the CIR/CNN findings regarding Pride's billing, Vera expressed concern. "If true," she said, "I would ask the question as to why are we contracting with this agency."

But Viernes said the message is pretty clear: Help the clinics improve instead of cutting them off.

"There's so much political pressure on us about giving them a second chance," he added. "After all, we're a rehab agency, we believe in giving second chances."

And, as CIR and CNN found, government regulators will dole out second and third chances to just about anyone.

Got a story idea or tip for CNN's investigations team? Go to cnn.com/investigate or click here to submit. CNN senior investigative producer Scott Zamost, CNN investigative correspondent Drew Griffin and CIR intern Mihir Zaveri contributed to this report. This story was edited by Amy Pyle, Robert Salladay and Mark Katches, with contributions from Richard T. Griffiths of CNN. It was copy edited by Nikki Frick and Christine Lee.

Reprinted with permission of Center for Investigative Reporting.

Source: http://rss.cnn.com/~r/rss/cnn_latest/~3/LVvDFzzLovg/index.html

Steve Alford Phil Spector Phil Ramone louisville Kevin Ware Injury Video Richard Griffiths FGCU